In the contemporary global financial landscape, a multitude of multinational corporations and banks find themselves entwined in investments associated with the sale of arms and military equipment to Israel. These involvements pose ethical dilemmas, especially concerning the oppression of Palestinians.

An in-depth exploration of these entities unveils a network of connections that can impact consumer choices, investment decisions, and professional engagements. Let’s delve into these insights to navigate conscientious decision-making across banking, insurance, retail, and corporate investments.

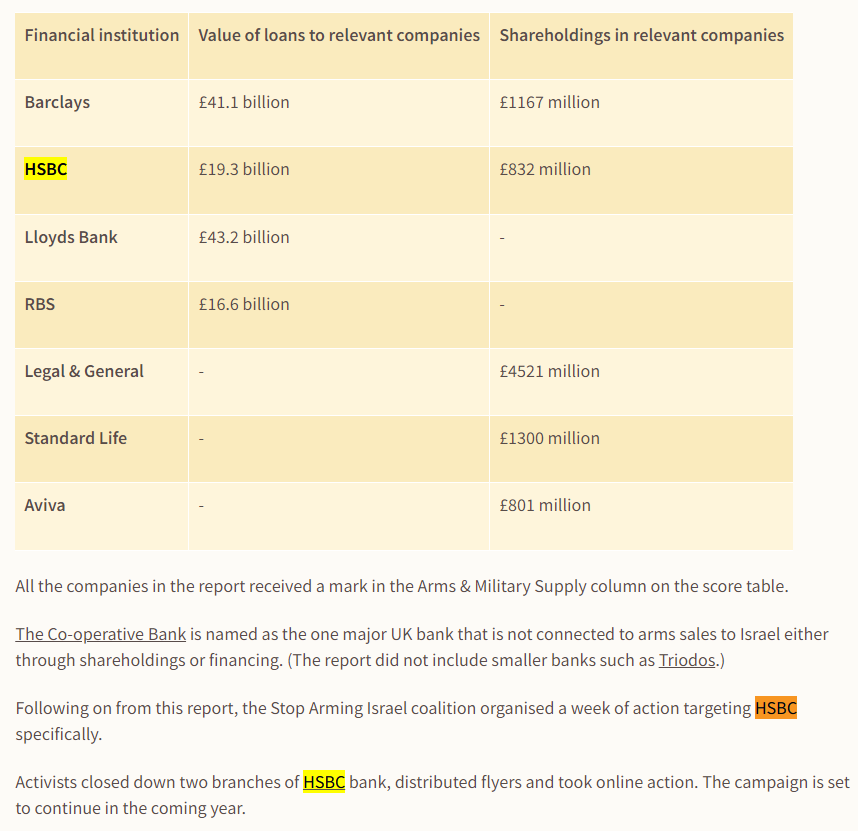

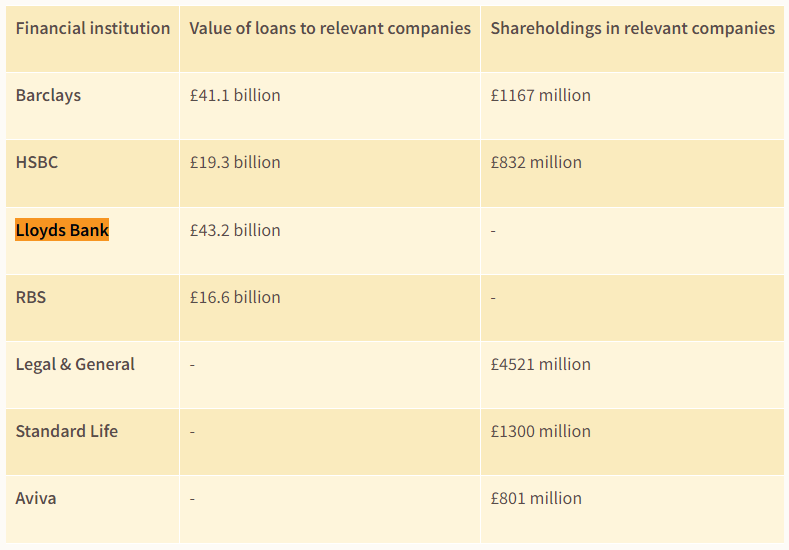

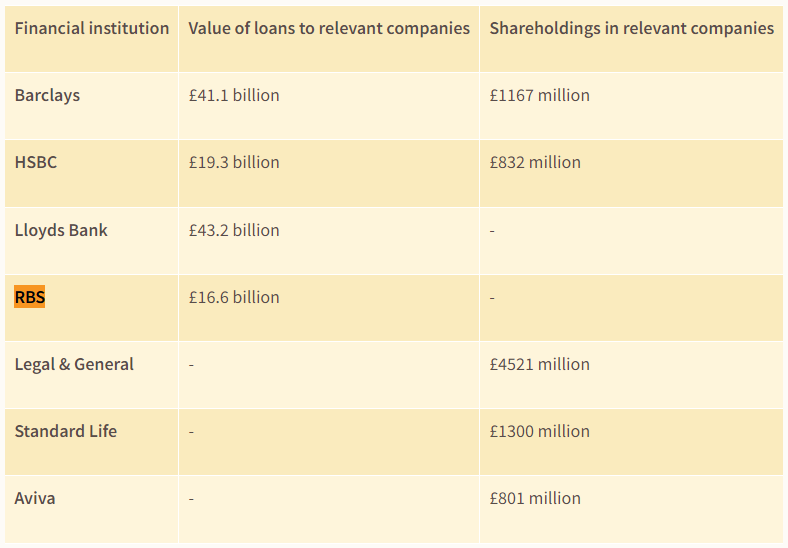

1. HSBC

A significant multinational bank, HSBC’s investments in companies selling arms to Israel raise ethical concerns about Palestinian oppression. Closing HSBC accounts, including credit cards or lending options, and avoiding banking with HSBC are prudent steps. Reconsidering employment with HSBC is also advisable.

2. Barclays

A multinational bank heavily invested in companies selling arms to Israel, Barclays’ practices raise ethical red flags. Closing Barclays accounts, including any lending options or Barclaycards, is a suggested action. Furthermore, avoiding employment at Barclays is a choice worth considering.

See Also: Luxury Companies Affiliated with Israeli Investments

3. Lloyds Bank

Lloyds’ investments in companies selling arms to Israel prompt ethical concerns. Closing Lloyds accounts, including credit cards and lending options, is a recommended action. Avoiding banking with Lloyds and reconsidering employment there are sensible choices.

4. AXA

As a leading French multinational insurer, AXA’s investments in Israeli banks linked to occupation and apartheid in Palestine warrant scrutiny. Reevaluating AXA as an insurance provider, potentially switching to an alternative, is a consideration. Additionally, thoughtfulness is required when contemplating employment with AXA.

5. RBS

The major Scottish bank’s investments in companies associated with arms sales to Israel are concerning. Closing RBS accounts, including lending options or credit cards, is a sensible move. Avoiding banking with RBS and reconsidering employment there are thoughtful decisions.

6. Marks and Spencer / M&S

While M&S has historical ties with Israel, recent distancing from political affiliations suggests a nuanced stance. Exercising discretion when shopping at M&S and weighing this information when considering employment with the company is advised.

See Also: Pharmaceutical Companies Affiliated with Israel

7. Tesco

Tesco’s partnership with a staunchly Zionist Israeli start-up for till-less stores in London has raised ethical queries. Refraining from purchasing Tesco products, especially from their GetGo stores, and expressing concerns to pressure Tesco to rethink their partnership are advisable actions.

8. Aviva

A significant insurer and pensions provider, Aviva’s investments in companies connected to arms sales in Israel prompt concerns regarding Palestinian oppression. Ethically-minded individuals may contemplate switching pensions and avoiding Aviva insurance products. Moreover, reconsidering employment with Aviva is advisable.

9. Standard Life

The company’s investments in firms selling arms to Israel raise ethical concerns. Reconsidering the use of their savings or pensions, as well as their insurance products, is recommended. Weighing these factors when considering employment with Standard Life is also prudent.

10. Legal & General

A notable British financial services company, Legal & General’s investments in companies associated with arms sales to Israel raise ethical questions. Reassessing investments or pensions with Legal & General is prudent. Moreover, reconsidering the use of their insurance products and avoiding employment with Legal & General is a thoughtful approach.

11. Lemonade

The recent Lemonade town hall meeting focused on addressing and sharing reflections, emotions, and analysis concerning the attack by Hamas on Israel. Originally not intended for public release, the content is raw and intimate, but in response to team members’ encouragement, it has been made accessible to everyone.

As consumers and potential employees, understanding the intricate financial connections of major entities is essential for aligning choices with personal ethics. The ethical quandary posed by these investments in companies linked to Israel’s arms trade demands careful consideration.

By being discerning in banking choices, investment destinations, and consumer behaviors, individuals can contribute to a more conscientious global financial ecosystem and, in turn, advocate for ethical business practices and social justice.

Companies That Support Israel: A List to Avoid

Does Red Bull Support Israel? Decoding the Unraveled Connection

Fast Food Chains Aligned with Israel Support

Boycott List: Fashion Companies Supporting Israel You Should Be Aware Of

Does These Firearms Support Israel? Exploring the Unraveled Connection

Does These Tech Brands Support Israel? Decoding the Unraveled Connection

Does These Filmography Support Israel? Understanding the Intricate Ties

Does These Online Business Support Israel? Exploring the Unraveled Connection